Performance bonds play a critical role in the construction and contract sectors, ensuring that projects are completed as per the agreed terms. However, securing a contract performance bond is often riddled with challenges that can leave contractors and businesses feeling overwhelmed. In this article, we will explore the common challenges when securing performance bonds and how to overcome them.

Understanding Performance Bonds

What is a Performance Bond?

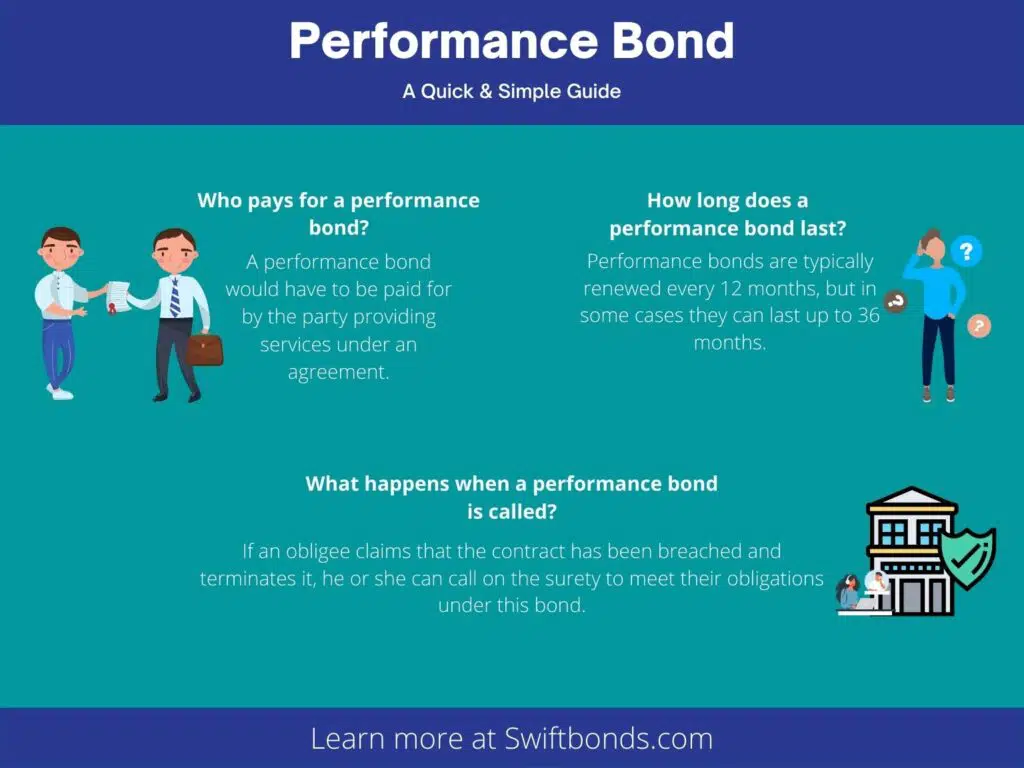

A performance bond is a type of surety bond that guarantees the completion https://sites.google.com/view/swiftbond/performance-bonds/what-is-difference-between-surety-guarantee-and-performance-bond_1 of a project in accordance with the contractual obligations. If the contractor fails to fulfill their responsibilities, the surety company compensates the project owner for any financial loss incurred.

Types of Performance Bonds

Contract Performance Bonds

These bonds ensure that contractors complete their work as specified in the contract.

Bid Bonds

Bid bonds guarantee that a contractor will accept a contract if awarded and provide a form of security against withdrawal.

Maintenance Bonds

These bonds cover repairs or defects after project completion for a specified period.

Common Challenges When Securing Performance Bonds and How to Overcome Them

1. Lack of Understanding of Bond Requirements

Many contractors face difficulties due to insufficient knowledge about what is required to secure a bond.

Solution: Education and Training

It's crucial for contractors to invest time in understanding bonding requirements. Various online courses and resources can clarify these aspects.

2. Poor Credit History

A contractor's credit history plays an important role in securing performance bonds. A poor credit score may lead to higher premiums or outright denial.

Solution: Improving Credit Score

Contractors should take proactive steps to improve their credit scores by paying bills on time, reducing debt, and monitoring credit reports regularly.

3. Incomplete Project Documentation

Insufficient or incomplete documentation can delay or prevent bond approval.

Solution: Comprehensive Documentation Preparation

Creating detailed project proposals, including timelines, budgets, and previous work experience can expedite the bonding process significantly.

4. High Bonding Costs

Bonding costs can be prohibitive for smaller contractors who may not have large capital reserves.

Solution: Shop Around for Better Rates

Contractors should seek quotes from multiple surety companies to find competitive rates that fit their budget constraints.

5. Insufficient Work History

Lack of experience or work history can make it difficult for new contractors to secure performance bonds.

Solution: Partner with Experienced Contractors

Newer firms might partner with more established contractors who have the necessary bonding capacity while gaining valuable experience in the process.

6. Complexity of Surety Applications

The application process for securing performance bonds can be complex and tedious.

Solution: Hire Experienced Brokers

Engaging professional brokers who specialize in surety bonds can streamline this process significantly by helping navigate through requirements effectively.

7. Limited Access to Surety Companies

Some regions may have limited access to surety companies willing to underwrite contracts for specific industries or types of projects.

Solution: Online Resources & Networking

Utilizing online platforms and industry networks can help connect contractors with national or regional surety providers willing to extend coverage in performance bonds underserved areas.

8. Delays Due to Financial Reviews

Sureties often conduct thorough financial reviews before issuing a bond, which can cause delays in project timelines.

Solution: Prepare Financial Statements Ahead of Time

Keeping accurate financial records and being prepared with statements can speed up this assessment phase considerably.

FAQs About Common Challenges When Securing Performance Bonds

1. What is the primary purpose of a performance bond?

The main purpose of a performance bond is to ensure that contractual obligations are met, providing financial protection for project owners against contractor default.

2. How do I know if I need a performance bond?

Typically, if you’re bidding on public contracts or larger private projects, you will likely be required to secure a performance bond as part of your bid package.

3. Can I obtain a performance bond without prior experience?

While it’s possible, having previous experience helps establish credibility; thus partnering with experienced firms could be beneficial when starting out.

4. What factors affect performance bond costs?

Factors like credit history, project size, complexity, and overall risk assessment by the surety company influence costs significantly.

5. How long does it take to secure a performance bond?

The timeline varies based on documentation readiness but generally ranges from several days up to weeks depending on complexity and availability of information needed by the surety provider.

6. Are there different requirements for private vs public projects regarding bonds?

Yes, public projects often have stricter regulations regarding bonding compared to private contracts where requirements may vary widely based on agreements made between parties involved.

Conclusion

Securing performance bonds presents its fair share of challenges; however, understanding these hurdles is half the battle won. By taking proactive measures—whether it’s improving financial standing or seeking expert advice—contractors can navigate through potential issues more effectively.

Ultimately, recognizing common challenges when securing performance bonds allows businesses not only to meet compliance standards but also ensures successful project completion while protecting all parties involved from unforeseen pitfalls along the way.

This article provides insights into common challenges associated with securing contract performance bonds while offering practical solutions aimed at overcoming them effectively.