Introduction

Navigating the labyrinth of construction bonding can feel overwhelming, especially when regulations seem to shift like sand. In the construction industry, bonding serves as a crucial mechanism ensuring that projects are completed satisfactorily and that all parties involved are protected financially. However, with evolving compliance requirements, it’s essential to stay updated on changes in bonding regulations to avoid costly penalties and project delays. So, how can you maintain compliance with these changing bonding regulations? This article delves into effective strategies, best practices, and insightful https://sites.google.com/view/swiftbond/performance-bonds/how-to-review-a-performance-bond_1 tips to help you stay ahead of the curve.

Understanding Construction Bonding Requirements

What Are Construction Bonds?

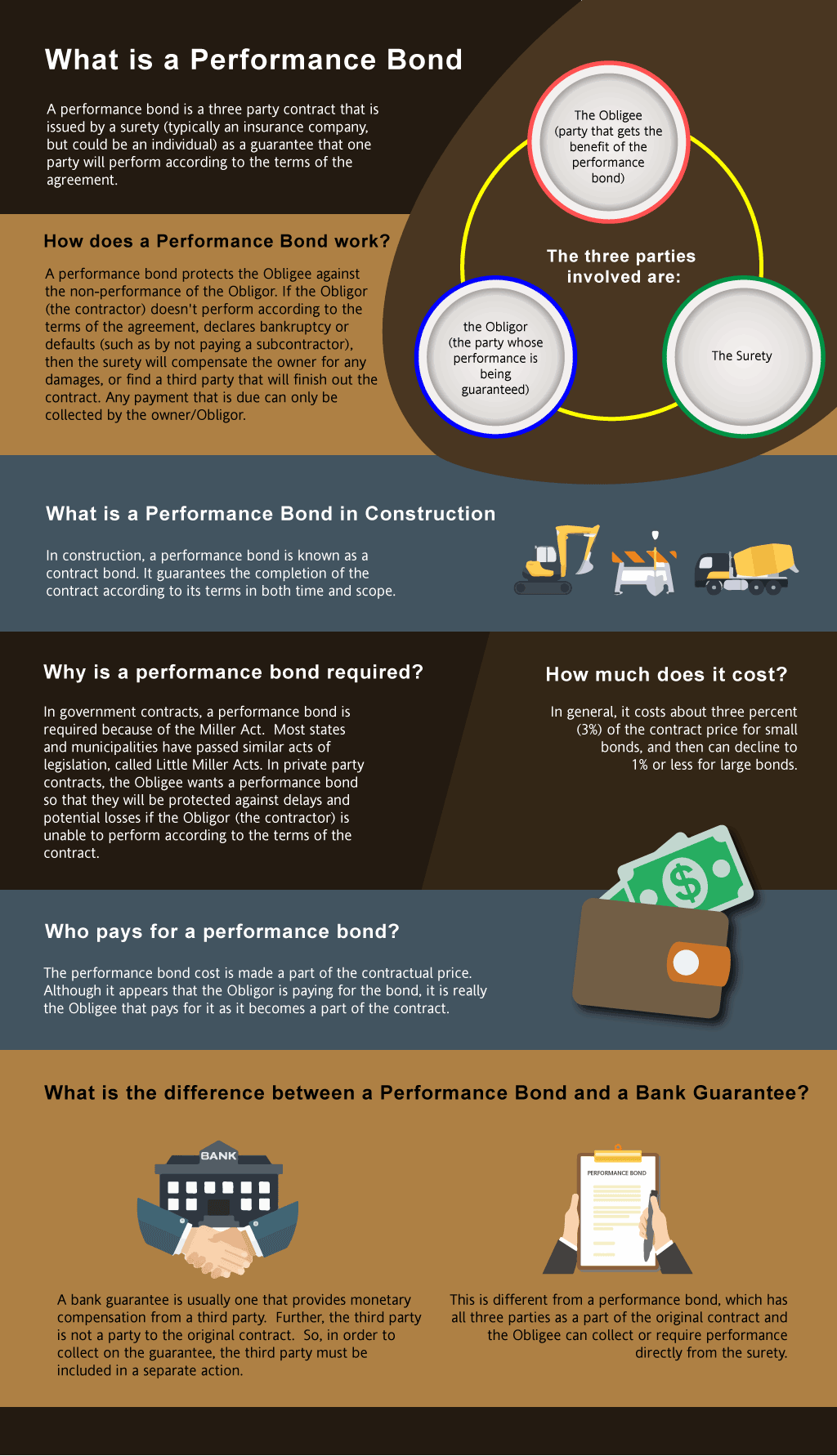

Construction bonds are legally binding agreements that provide a guarantee for the completion of a project according to specified terms. They protect various stakeholders in the construction process, including project performance bonds owners and subcontractors. Common types of bonds include performance bonds, payment bonds, and bid bonds.

Types of Construction Bonds

Performance Bonds: Ensure that contractors fulfill their obligations as per contract terms. Payment Bonds: Guarantee that subcontractors and suppliers will be paid for their work. Bid Bonds: Protect project owners from losses if a contractor fails to execute the contract after winning a bid.Why Are Bonding Requirements Important?

Bonding requirements serve several critical functions:

- They mitigate financial risks for project owners. They ensure accountability among contractors. They enhance trust within the construction industry.

The Importance of Staying Updated on Bonding Regulations

Why Do Bonding Regulations Change?

Bonding regulations evolve for various reasons:

- Legislative changes at federal or state levels. Economic fluctuations impacting the construction industry. Emerging trends in risk management practices.

Consequences of Non-compliance

Failing to comply with bonding regulations can lead to:

- Legal penalties. Project delays or cancellations. Damage to your reputation within the industry.

How to Maintain Compliance with Changing Bonding Regulations

Regular Training and Education Programs

Continuous Learning

Invest in ongoing training programs for your team about current bonding requirements. Regular workshops or webinars can keep everyone informed about updates in legislation and best practices.

Certification Programs

Encourage employees to pursue certifications related to construction law or bonding procedures. This not only enhances their skills but also ensures your firm adheres to compliance standards.

Utilizing Technology for Monitoring Regulations

Compliance Management Software

Employ software solutions designed specifically for tracking regulatory changes. These tools can provide timely alerts regarding new bonding requirements applicable to your projects.

Online Resources

Leverage online platforms such as government websites or reputable industry associations where updates on bonding regulations are frequently posted.

Establishing Strong Relationships with Surety Companies

Open Communication Channels

Develop strong ties with surety companies who can offer insights into regulatory changes affecting your projects. Their expertise can be invaluable when navigating complex compliance landscapes.

Regular Reviews

Schedule periodic reviews with your surety provider to discuss any potential changes in bonding requirements relevant to your business operations.

Best Practices for Compliance Management

Document Everything Thoroughly

Keeping Records

Maintain meticulous records of all bond-related documents. This includes applications, agreements, and correspondence with surety providers—having detailed archives simplifies audits and inspections.

Digital Documentation Systems

Consider adopting digital documentation systems that enable easy access and organization of all relevant documents related to bonding compliance.

Conduct Internal Audits Regularly

Importance of Self-assessment

Internal audits allow you to identify areas where compliance may be lacking before external regulators do. Use these audits as learning opportunities rather than just checks on the box.

Checklist Approach

Create checklists based on current bonding regulations which your team must complete periodically during projects—this ensures adherence throughout the construction process.

Common Challenges in Maintaining Compliance

Navigating Complex Regulatory Landscapes

Varied State Regulations

Understand that each state may have different requirements regarding construction bonding—ensure you're familiarized with local laws relevant to your projects.

Dealing with Changes Mid-project

When regulations change mid-project, it can create confusion—maintaining clear communication lines can help mitigate misunderstandings among stakeholders involved in the project.

Resource Allocation Issues

Budget Constraints

Allocate sufficient resources toward compliance management; underfunded initiatives often fall by the wayside during busy periods within projects—financial investment is pivotal for successful outcomes.

Time Limitations

Ensure staff has dedicated time set aside specifically for compliance tasks—balancing day-to-day responsibilities alongside regulatory needs is essential without compromising either aspect's quality.

FAQs About Maintaining Compliance with Changing Bonding Regulations

What are the most common types of construction bonds?- The most common types include performance bonds, payment bonds, and bid bonds—all serve distinct purposes within a project's lifecycle.

- Bonding regulations can change frequently due primarily to legislative shifts; staying informed through regular training is crucial.

- Non-compliance may result in legal penalties, project delays or cancellations, and damage to reputation within the industry—a costly mistake indeed!

- Absolutely! Utilizing compliance management software helps track regulatory changes while providing timely alerts about new requirements relevant specifically tailored towards your business operations!

- Yes! Performance bonds guarantee contractual obligations' fulfillment while payment bonds ensure subcontractors/suppliers receive due payments; both protect different stakeholders' interests!

- Surety companies offer expertise regarding regulatory frameworks—they provide guidance through complexities associated with changing bond requirements which helps ensure smooth operational flow throughout processes!

Conclusion

Maintaining compliance with changing bonding regulations is no small feat—it requires diligence, education, strong relationships within industries concerned (like sureties), thorough documentation practices along proactive auditing measures! By implementing these strategies outlined above into routine operations not only protects against unforeseen disruptions but also enhances overall credibility amongst peers leading towards successful outcomes across all future endeavors!

By staying informed about current trends affecting construction bonding requirements while fostering an environment focused on continuous improvement ensures long-term sustainability thereby enhancing both profitability & growth opportunities alike!

In summary, understanding how best practices combine together creates a comprehensive framework capable enough addressing ever-evolving needs arising from dynamic environments encountered regularly across multiple sectors including yours too! So remember: “Stay educated; communicate effectively; document thoroughly—and keep those relationships alive!”