Introduction

In the intricate world of insurance and bonding, where complexities often obscure clarity, Swiftbonds stands out as a beacon of client-centric philosophy. This approach not only shapes the company's internal culture but also has a profound impact on the overall quality of service provided to clients. The interplay between client needs and company offerings can often determine the success or failure of an enterprise in today’s competitive environment.

In this article, we will explore Swiftbonds’ Client-Centric Philosophy and Its Impact on Service Quality in detail. We'll dissect how this philosophy is implemented within the organization, its implications for customer satisfaction, and its role in distinguishing Swiftbonds from other players in the industry. We'll also touch upon common questions regarding bond companies and their relevance in today’s market.

Understanding Swiftbonds’ Client-Centric Philosophy

What is Client-Centricity?

Client-centricity refers to an approach where the client's interests, needs, and experiences are placed at the forefront of business operations. It emphasizes listening to clients, understanding their pain points, and tailoring services accordingly.

The Genesis of Swiftbonds’ Philosophy

Founded on principles of transparency and reliability, Swiftbonds developed its client-centric philosophy by recognizing that each client's situation is unique. This understanding laid the groundwork for a service model that prioritizes personalized interaction.

Core Elements of Client-Centric Philosophy

Empathy: Understanding client emotions and concerns. Communication: Maintaining open lines for feedback. Flexibility: Adapting services based on individual client needs. Transparency: Being honest about processes, costs, and potential risks.How Does This Philosophy Affect Service Delivery?

Implementing a client-centric philosophy means that every facet of service delivery—from initial contact to post-service follow-up—is designed around meeting client expectations. This holistic approach enhances customer loyalty and fosters long-term relationships.

The Role of Insurance Bond Companies in Client Satisfaction

Why Are Insurance Bonds Important?

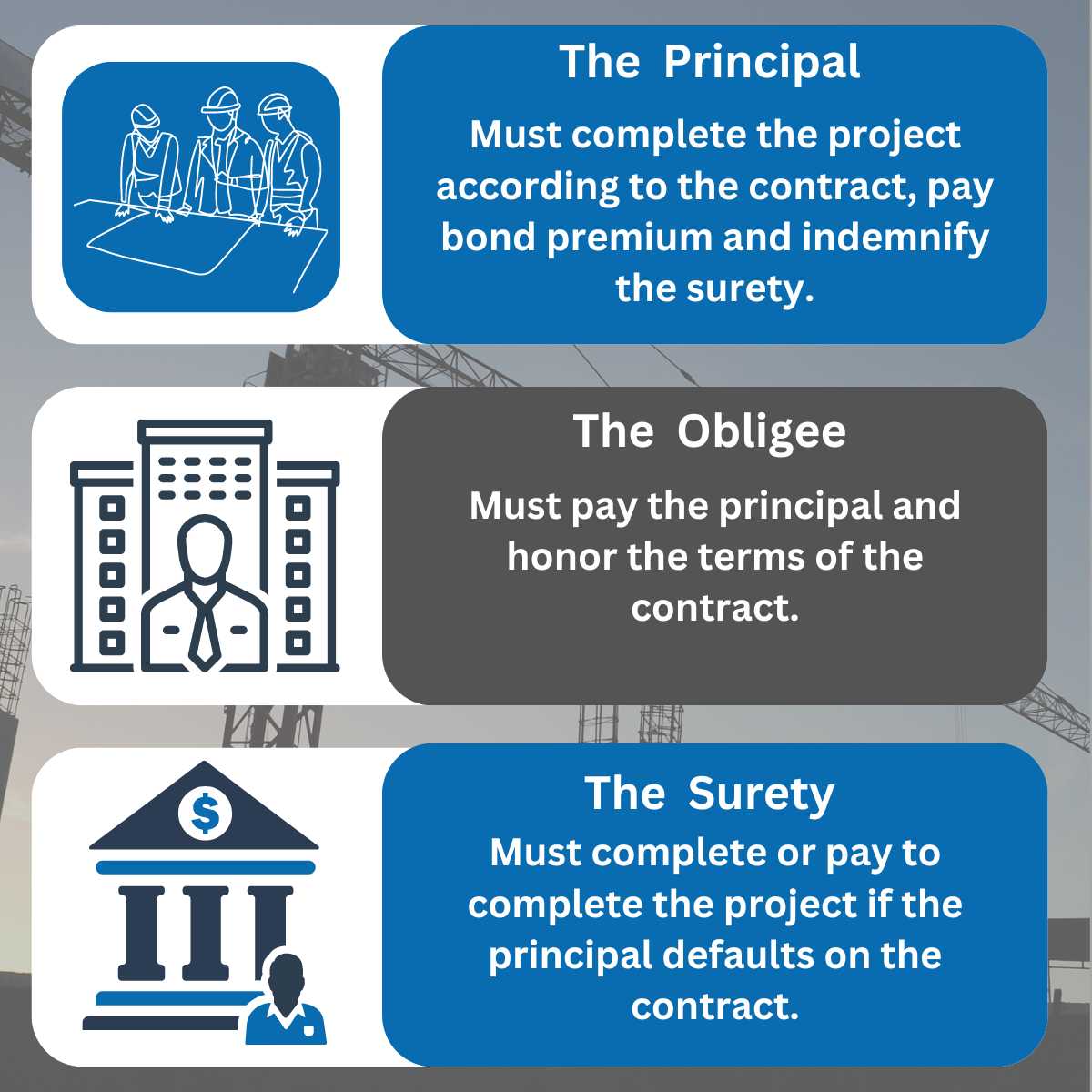

Insurance bonds serve as guarantees for projects or agreements between parties. They protect against losses stemming from defaults or failures to meet obligations.

Common Types of Insurance Bonds Offered

- Performance Bonds Payment Bonds Bid Bonds License and Permit Bonds

These bonds ensure that clients are safeguarded against various risks associated with contractual obligations.

How Do Insurance Bond Companies Ensure Quality Service?

Insurance bond companies like Swiftbonds focus on establishing rigorous standards for assessing risk factors associated with each bond they underwrite. This meticulous approach ensures that clients receive tailored solutions that effectively mitigate their specific risks.

Customer Engagement Strategies at Swiftbonds

Building Relationships Through Trust

Trust is foundational in any business relationship. Swiftbonds surety bond FAQ cultivates trust by being transparent about their processes and maintaining consistent communication throughout the bonding process.

Utilizing Technology for Better Communication

With advancements in technology, Swiftbonds leverages digital platforms to enhance customer engagement:

- Online portals for tracking bond statuses Chatbots for immediate responses Social media engagement for building community

Regular Feedback Loops

By actively seeking feedback through surveys and direct outreach, Swiftbonds demonstrates a commitment to continuous improvement based on actual client experiences.

The Implications of Client-Centricity on Service Quality

Increased Customer Satisfaction Rates

Research shows that companies prioritizing client-centric practices tend to have higher customer satisfaction rates. For instance, clients who feel heard are more likely to recommend services to others.

Enhanced Reputation Within the Industry

A strong reputation can be built through word-of-mouth referrals driven by satisfied customers. As such, Swiftbonds has managed to create a positive image among both clients and competitors alike.

Case Studies: Success Stories from Clients

Project A: Construction Firm Bonding Experience

A construction firm approached Swiftbonds requiring performance bonds for multiple projects simultaneously. By understanding their unique challenges—like fluctuating project timelines—Swiftbonds tailored a solution leading to successful project completions without delays or financial loss.

Outcome: Increased trust led to additional bonding requests over time.

Project B: A Local Business Seeking Licensing Bonds

A small business needed licensing bonds quickly due to impending deadlines with local regulations. Recognizing the urgency, Swiftbonds expedited their process while ensuring compliance with all necessary regulations.

Outcome: The business obtained its license on time—boosting its operational capacity significantly.

Training Staff for Client-Centric Excellence

The Importance of Employee Training Programs

At Swiftbonds, employees undergo extensive training focused not just on technical skills but also on developing soft skills essential for providing outstanding customer service.

Continuous Learning Culture

Encouraging employees to participate in workshops helps them stay updated with industry trends while honing empathetic communication skills further enhances service quality.

Measuring Success: Key Performance Indicators (KPIs)

Defining KPIs Relevant to Client-Centric Services

To ensure accountability surety bonds in delivering quality service aligned with their philosophy, Swiftbonds tracks various KPIs:

Customer Satisfaction Scores (CSAT) Net Promoter Score (NPS) Retention Rates Response Times

These metrics provide invaluable insights into areas needing improvement or reinforcement.

Challenges Faced by Client-Centric Companies Like Swiftbonds

Navigating Diverse Client Expectations

Every client presents unique challenges regarding expectations; understanding these nuances becomes paramount yet challenging at times.

Balancing Efficiency with Personalization

While striving for personalized service can enhance satisfaction levels immensely, it can sometimes lead to inefficiencies if not managed correctly—finding the right balance is crucial!

Future Trends in Client-Centric Services

The Rise of Artificial Intelligence

As technology continues evolving, AI tools can help analyze vast amounts of data leading towards more tailored solutions that align closely with individual client needs while improving operational efficiency simultaneously!

Sustainability Practices Among Bond Companies

Modern clients increasingly prefer working with companies committed to sustainability practices—swiftly adapting strategies not only benefits clients but also contributes positively towards global efforts!

Frequently Asked Questions (FAQs)

What makes a company truly client-centric?- A company becomes genuinely client-centric when it places customer needs above all else—actively listens & adapts services accordingly!

- They maintain robust compliance protocols & conduct regular audits ensuring adherence throughout operations!

- Performance bonds guarantee project completion as per agreed terms safeguarding interests involved!

- Technology simplifies communication channels enabling quicker responses & better transparency across processes!

- Well-trained employees equipped with soft skills enhance interactions leading towards improved customer satisfaction levels significantly!

- Construction & contracting industries primarily rely heavily upon these assurances ensuring financial security whilst fostering trust among stakeholders involved!

Conclusion

In conclusion, embracing a client-centric philosophy like that practiced by Swiftbonds carries substantial weight regarding enhancing service quality within insurance bond companies today! By focusing intently upon individual needs while integrating modern technologies alongside robust training programs—it illustrates how businesses can adapt successfully amidst evolving market dynamics whilst cultivating lasting relationships built upon trust! Through this comprehensive exploration into Swiftbonds’ Client-Centric Philosophy and Its Impact on Service Quality, it becomes evident how strategic alignment towards fulfilling consumer demands ultimately drives success forward!