In today's dynamic financial landscape, choosing the right bond company is more crucial than ever. With a plethora of options available, the decision can often feel overwhelming. However, understanding the intricate relationship between financial stability and selecting an appropriate bond company can pave the way for sound investments and long-term security.

Understanding Financial Stability

What is Financial Stability?

Financial stability refers to a condition where a company's financial system operates efficiently without undue risk surety bonds of collapse. It encompasses several factors, including liquidity, solvency, profitability, and creditworthiness. For individuals and businesses alike, achieving financial stability means having enough resources to meet liabilities while also enabling growth.

Importance of Financial Stability

Financial stability is vital for both personal and corporate finance. On a personal level, it allows individuals to navigate unexpected expenses without falling into debt. For companies, financial stability fosters investor confidence and promotes sustainable growth.

The Role of Bond Companies in Financial Security

What Are Insurance Bond Companies?

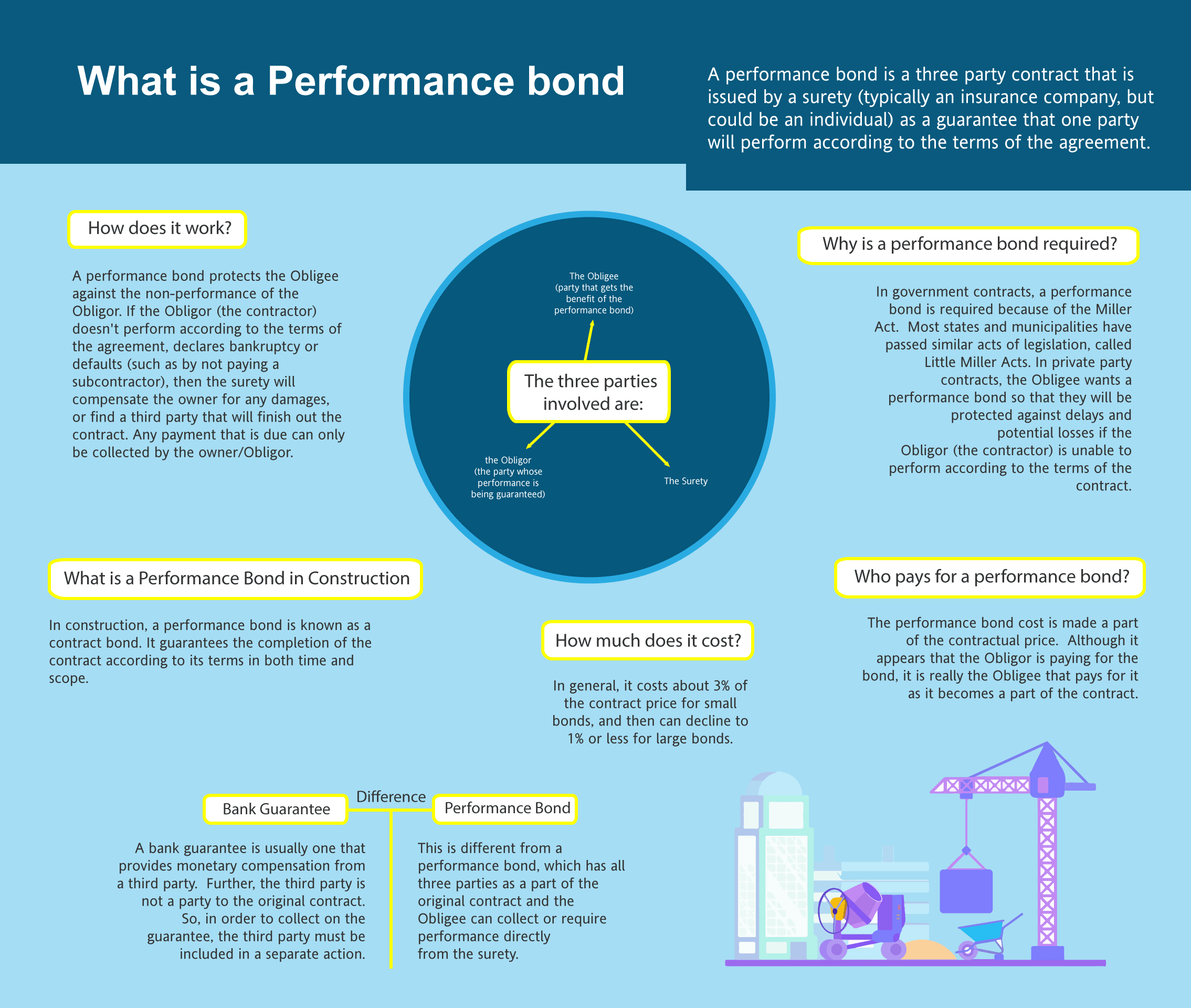

Insurance bond companies are specialized entities that provide financial guarantees through various types of bonds. These bonds serve as a form of insurance against potential financial losses related to contracts or obligations. They play a significant role in minimizing risk for individuals and businesses alike.

Types of Bonds Offered by Insurance Bond Companies

Performance Bonds: Ensure that contractors complete projects as per terms. Bid Bonds: Guarantee that bidders will honor their bids. Payment Bonds: Protect subcontractors from non-payment. License and Permit Bonds: Required for regulatory compliance. Court Bonds: Assure court performance or fiduciary duties.Assessing Your Financial Situation Before Choosing a Bond Company

Evaluating Your Financial Needs

Before diving into the world of bonds, it's essential to assess your financial needs carefully. Ask yourself:

- What are my current liabilities? Do I have any upcoming projects that require bonding? How much risk am I willing to shoulder?

A thorough evaluation will help you pinpoint which type of bond best suits your situation.

Understanding Your Risk Tolerance

Risk tolerance varies among individuals and organizations. Understanding your comfort level when it comes to risk can guide you towards selecting an insurance bond company that aligns with your financial philosophy.

The Link Between Financial Stability and Choosing the Right Bond Company

Selecting an insurance bond company isn't just about finding the lowest rates; it's about ensuring that the company can uphold its promises get more info during challenging times. A financially stable bond company can provide assurance that they’ll fulfill their commitments when needed most.

Key Indicators of a Reliable Bond Company

Financial Ratings: Review ratings from agencies like A.M. Best or Moody's. Claims History: Investigate how often claims are paid out. Customer Reviews: Look at feedback from previous clients regarding their experiences.Factors to Consider When Choosing an Insurance Bond Company

Reputation Matters

The reputation of a bond company is paramount in making an informed choice. A company with high customer satisfaction ratings is likely more reliable than one riddled with complaints.

Experience Counts

An established bond company has weathered various market conditions and understands the intricacies involved in providing bonds effectively.

Coverage Options Available

Not all insurance bond companies offer the same range of products; ensure that your selected company provides coverage relevant to your specific needs.

How to Evaluate Insurance Bond Companies?

Researching Potential Candidates

Start by gathering information on several insurance bond companies through online reviews, testimonials, and industry ratings.

| Criteria | Company A | Company B | Company C | |---------------------------|------------------|------------------|------------------| | Financial Rating | A | B+ | A- | | Claims Payout History | 95% | 80% | 90% | | Customer Satisfaction | 4/5 | 3/5 | 4/5 |

Comparing Quotes Effectively

Once you've narrowed down potential candidates, request quotes from each one. Compare not only costs but also coverage details—fine print matters!

Common Misconceptions About Bond Companies

Myth 1: All Bond Companies Are The Same

This couldn't be further from the truth; each firm has its strengths and weaknesses based on various factors such as experience and specialty offerings.

Myth 2: The Cheapest Option Is Always Best

While price is essential, it should not be the sole deciding factor in choosing a bond company; evaluate overall value instead.

FAQs About Insurance Bond Companies

What are insurance bonds used for?- Insurance bonds are typically used as guarantees in various transactions or contractual obligations to protect parties against potential losses.

- If you're entering into contracts requiring assurance for completing work according to stipulated terms, then performance bonds are vital.

- Yes! Many companies are open to negotiation based on your unique needs or circumstances.

- Like any financial service provider, there are inherent risks if you choose an unreliable firm; thus due diligence is critical before committing.

- Depending on documentation readiness and underwriting processes, getting bonded may take anywhere from hours to weeks.

- If your claim gets denied, review the policy terms thoroughly; appeals may be possible depending on circumstances outlined therein.

Conclusion

The link between financial stability and choosing the right bond company cannot be overstated; making wise choices today lays a foundation for future security tomorrow. By conducting thorough research, evaluating personal needs against available options—and keeping abreast of market trends—you'll position yourself favorably within this intricate landscape of finance.

In conclusion, understanding how financial stability intertwines with selecting an appropriate insurance bond company ensures you make informed decisions that safeguard both investments and livelihoods alike—enabling both personal prosperity and business success in our ever-evolving economy!