Introduction

In the intricate world of construction, surety companies play a pivotal role, ensuring that projects are completed on time and within budget. However, the relationship between contractors and surety companies can often be fraught with misunderstandings and miscommunications. This is where transparency comes into play. Why Transparency is Key When Dealing with Surety Companies is not just a catchy phrase; it encapsulates the essence of building a trust-based relationship that benefits all parties involved. In this article, we will delve deep into why transparency matters in surety bonds, explore the construction bonding requirements, and offer practical advice for fostering open communication.

Understanding Surety Bonds

What Are Surety Bonds?

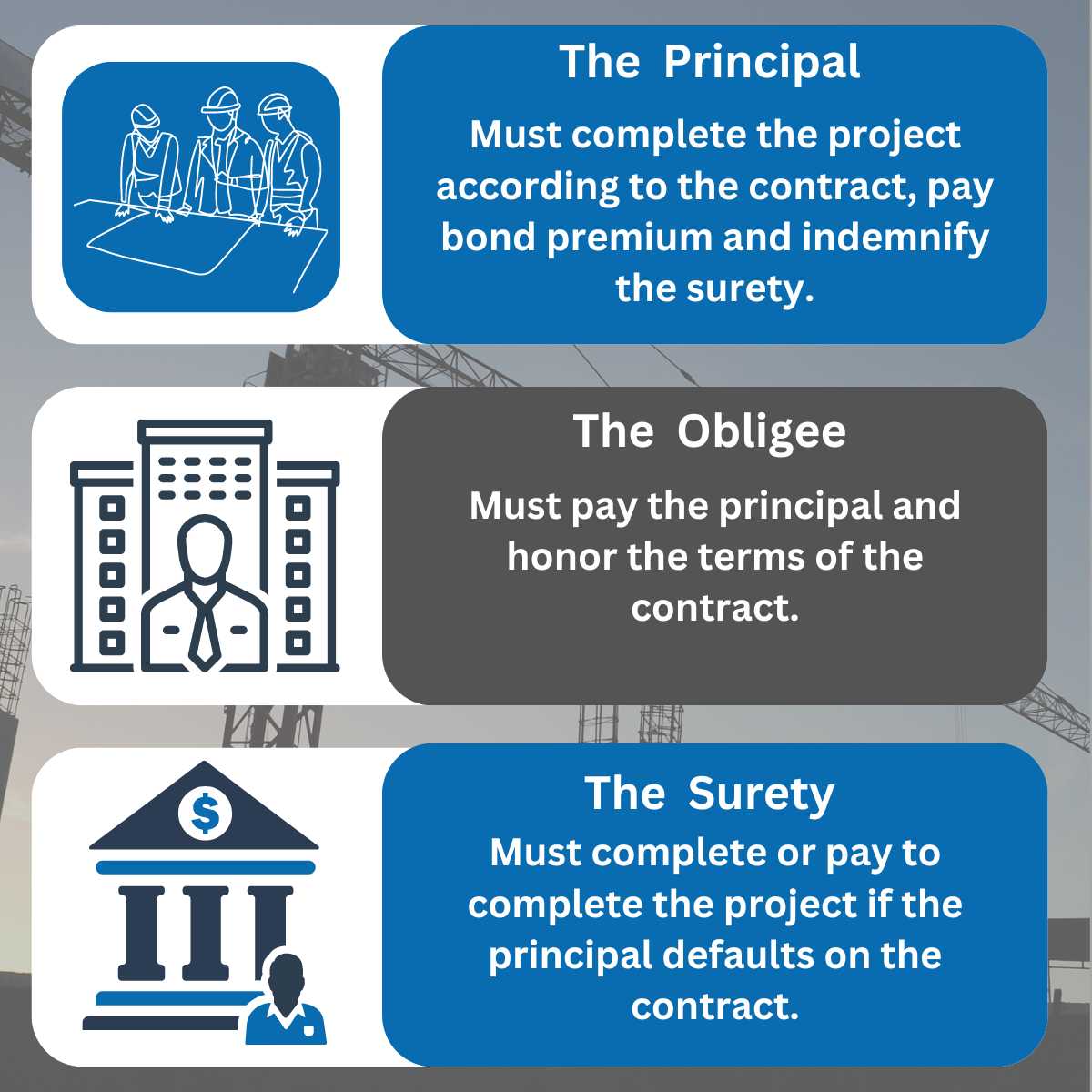

Surety bonds are legally binding agreements that ensure contractual obligations are fulfilled. They serve as a financial guarantee from the surety company to the project owner or obligee that the contractor will complete the work according to contractual terms.

Types of Surety Bonds

Bid Bonds: Ensures that a bidder on a project will accept the contract if awarded. Performance Bonds: Guarantees project completion and adherence to contract specifications. Payment Bonds: Ensures suppliers and subcontractors are paid for their work.Importance of Surety Bonds in Construction

Surety bonds protect all parties involved—owners, contractors, and subs—by providing assurance that contracts will be honored. This security promotes confidence in financial transactions within the construction industry.

Why Transparency is Key When Dealing with Surety Companies

Establishing Trust Through Openness

Transparency fosters trust between contractors and sureties. When both parties openly share information about finances, project timelines, and potential challenges, they can work together more effectively.

The Cost of Lack of Transparency

Not being transparent can lead to dire consequences More help — from cost overruns to project delays. A lack of clear communication can result in misunderstandings that may complicate claims processes or even lead to legal disputes.

Open Communication Channels

Creating open lines of communication means regularly updating stakeholders about project status, risks, and changes in scope. This proactive approach ensures everyone is on the same page.

Construction Bonding Requirements

Understanding Regulatory Frameworks

Different jurisdictions have specific bonding requirements based on local regulations. It's vital for contractors to familiarize themselves with these guidelines to ensure compliance.

Common Construction Bonding Requirements

- Financial Statements: Many sureties require detailed financial documents. Project Experience: Demonstrating past successes helps build credibility. Credit History: A strong credit score can ease bonding processes.

Documentation Needed for Bonding

Financial Statements Business Plans References from Past Projects Resumes of Key PersonnelBuilding Strong Relationships with Sureties

The Role of Mutual Respect

Building relationships based on mutual respect involves understanding each other's roles in the construction process. Contractors should appreciate the risk assessment roles played by sureties while sureties should recognize contractors' challenges in managing complex projects.

Setting Expectations Early On

From day one, it's crucial to articulate expectations clearly. Discuss what each party needs from one another upfront; this reduces confusion later down the line.

Regular Progress Updates

Frequent updates regarding project milestones can maintain transparency throughout the duration of a bond agreement. These updates should include both successes and setbacks alike; honesty strengthens trust.

Risk Management Strategies

Identifying Potential Risks Early

Successful projects begin with identifying potential risks early on—financial instability, resource shortages, or delayed approvals could derail timelines if not addressed promptly.

Creating Contingency Plans

Develop contingency plans for identified risks so everyone knows how to respond when challenges arise; this preparedness enhances confidence among all parties involved.

The Claims Process Explained

Understanding Claim Triggers

Claims can arise due to non-performance or failure to meet payment obligations—understanding these triggers allows parties to manage risks more effectively beforehand.

Navigating Claim Filings

Filing a claim involves documenting all relevant details meticulously—this documentation serves as evidence during disputes over bond claims or performance issues.

FAQs About Transparency with Surety Companies

Why is transparency important when dealing with surety companies?- Transparency builds trust and ensures effective collaboration between contractors and sureties, minimizing misunderstandings.

- Typically includes financial statements, business plans, references from past projects, and resumes of key personnel.

- It can lead to misunderstandings that complicate claims processes or result in rejected bonding applications.

- Bid bonds, performance bonds, and payment bonds are some common types utilized in construction projects.

- Regularly update them on project status and involve them early in risk discussions.

- Failing to meet bonding requirements can result in denied bond applications or complications during claim processes.

Conclusion

In conclusion, embracing transparency when dealing with surety companies is not merely an option—it’s essential for successful project execution within the construction landscape. By fostering open communication channels and adhering to construction bonding requirements diligently, all stakeholders can work cohesively towards common goals while minimizing risks associated with misunderstandings or miscommunications.

Remember — it's always better to be upfront about challenges rather than allowing them to escalate into larger problems down the road! Building strong relationships based on trust not only benefits your immediate performance bonds projects but also lays down pathways for future collaborations within this intricate industry landscape where every handshake counts!

By understanding why transparency is key when dealing with surety companies and incorporating these principles into your operations, you’ll build a stronger foundation—not just for your current projects but for your entire career within construction as well!